Most people who begin learning Forex & Commodities or Stock & Shares usually have one question on their mind: what’s the difference between trading strategies and is there a way to learn just one strategy and apply that?

While there are many reasons, today I will only touch upon a basic factor – one that is common between most individual traders. Since markets evolve from time to time, similarly circumstances also vary from trader to trader based upon his/her unique personal preferences. These different factors may be in terms of risk, time, capital, knowledge & education, experience and sometimes even technology. While I was browsing TE, I came across a simple description of what I’m discussing here, Day Trading vs Swing Trading Click to View. These are one of few trading techniques you will learn in our course. Hope you enjoy this!

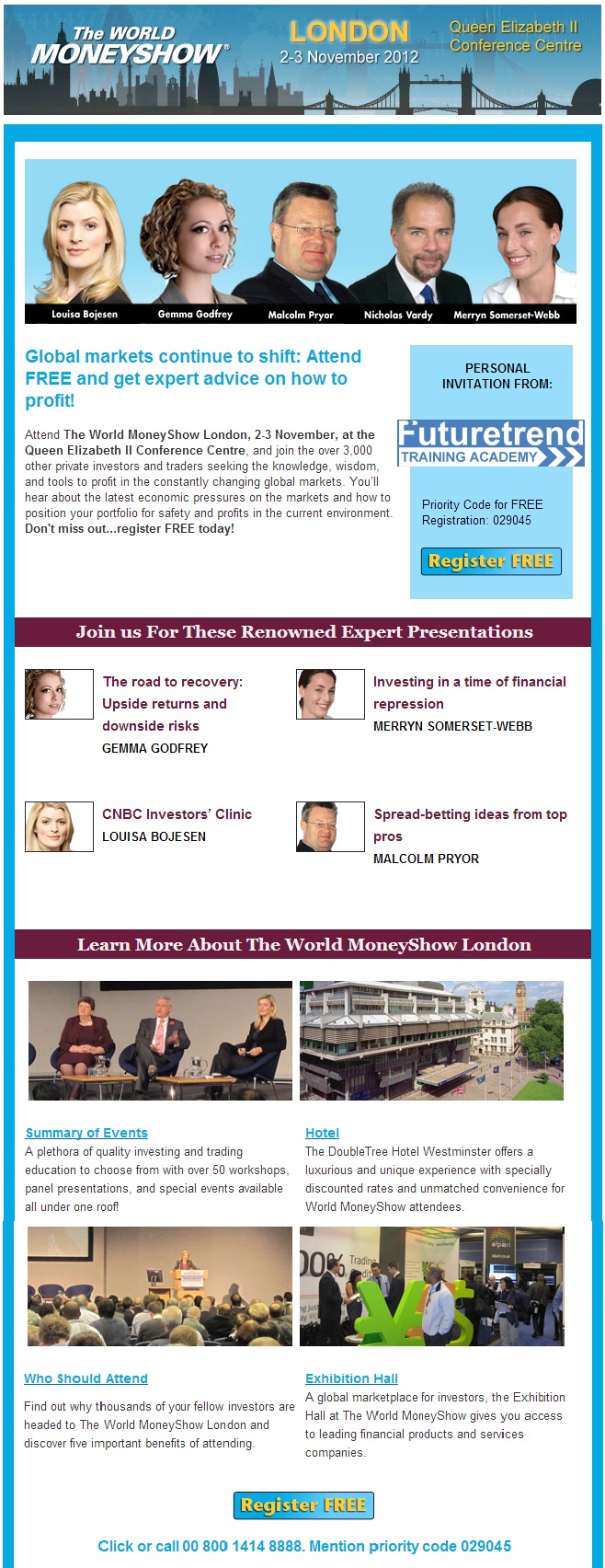

Do not forget to click on the picture below for a future announcement….

Learn Trading Strategies and Trading System

Everyday our students learn more and more from our advance trading courses (Forex & Commodities Trading) and gain considerable knowledge and expertise on how to trade markets systematically and consistently. The Second part of Forex and Commodities course emphasizes on trading strategies and trading systems to help establish trading rules, methodical approach, risks over rewards, technical and fundamental discipline, old-school(wall street) trading techniques and learning industries latest innovations and getting hands on experience on most advance trading technologies.

A backdrop to what I am discussing here is best illustrated in my upcoming webinar on Trading Financial Markets with 21st century style. Many of you may or may not be aware of the phenomenon called High Frequency Trading(HFT)- for those who do not know about HFT may also be unaware of Cross Atlantic Fiber-optic cables stretching from Long Island to the UK aka ‘QuanTA‘.

HFT aka Algorithmic or Automated Trading involves the use of computer software which is instructed by a set of configurable algorithms as and when to buy and/or sell products in an electronic marketplace. Considerations can include price, quantities, timing etc. Presently Financial Markets and all its application are evolving; however the question is whether many of us in future will like these changes? Frankly, I’m still not sure myself! But I must admit I do seek its benefits and at the same time recognize it as a potential threat at the minimal capital investor. I will be demonstrating a Two-part webinar on trading GOLD & SILVER using automated trading system. I will be presenting Algorithmic based strategies that my trading system promptly captures and informs me about. These trading alerts can be traded manually or can be automated to be executed on their own.