The current project is an ERP (Enterprise Resource Planning) software application for a company that deals with fashion & lifestyle products.

The application is needed for teams in the company that manage multiple consumer brand portfolios consisting of different products that are sold globally. The application includes bespoke requirements for the company itself and would be usable only by designated employees. These employees have been using a spreadsheet for a long time and want this target application to replace the spreadsheet and also do much more than what the spreadsheet does.

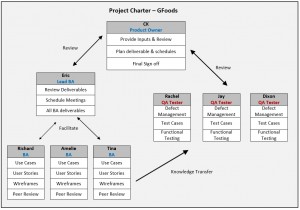

Business analyst and software testers work experience

The application is divided into multiple modules – Administrator module, where the Admin creates User profiles, Brand profiles, assigns permissions and restrictions to users based on their roles.

Actionlist Module- This is where the business activities related to marketing, advertising & promotion are handled by the users.

Reports module- This module deals with generation of reports of various types that display the information in the form of graphs/charts to the users.

In this project, the trainee Business Analysts have accomplished end to end tasks of a BA- from Analysis to Sign-off of the documents.

The tasks they have worked and completed are:

– Elicit & analyze project requirements

– Facilitate Client meetings & interactions

– Interview and clarify project expectations with the client

– Create Product backlog

– Define Business Requirements and create Business Requirements Documents

– Define Scope of the project

– Create Functional Requirements Document (FRD)

– Create Use Case Model based on users and functions identified

– Design Process flow for the project

– Create elaborate Use Cases & User stories

– Design Wire frames/mock-ups

– Get the documents/artifacts reviewed by Client

– Update documents based on Client’s inputs

– Understand the Testing process and create Test cases

– Get all project requirements frozen and BA documents signed off by the Client.

QA’s Quality Assurance analysts

were involved in

Test Planning,

Test Scripting,

Test Execution,

Defect Reporting and Tracking

Test Result and Completion reporting etc.

There is a new project in the pipeline and is expected to kick-off in mid June. It deals with the trading and auctioning of seafood and aquatic products in the international market. This project would actually demand the Business Analysts and Software Testers involved to exhibit their skills to the fullest as it is a complex application. Those who are familiar with subjects like trading, e-commerce, auctions will find it quite interesting and those that aren’t will be gaining valuable experience in a new domain.

For more details of what our work experience and mentoring program involves please visit our dedicated web page for this here:

http://www.careertesters.com/work-experience-mentoring.html